are campaign contributions tax deductible in 2019

The same goes for campaign contributions. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible.

Are Campaign Contributions Tax Deductible

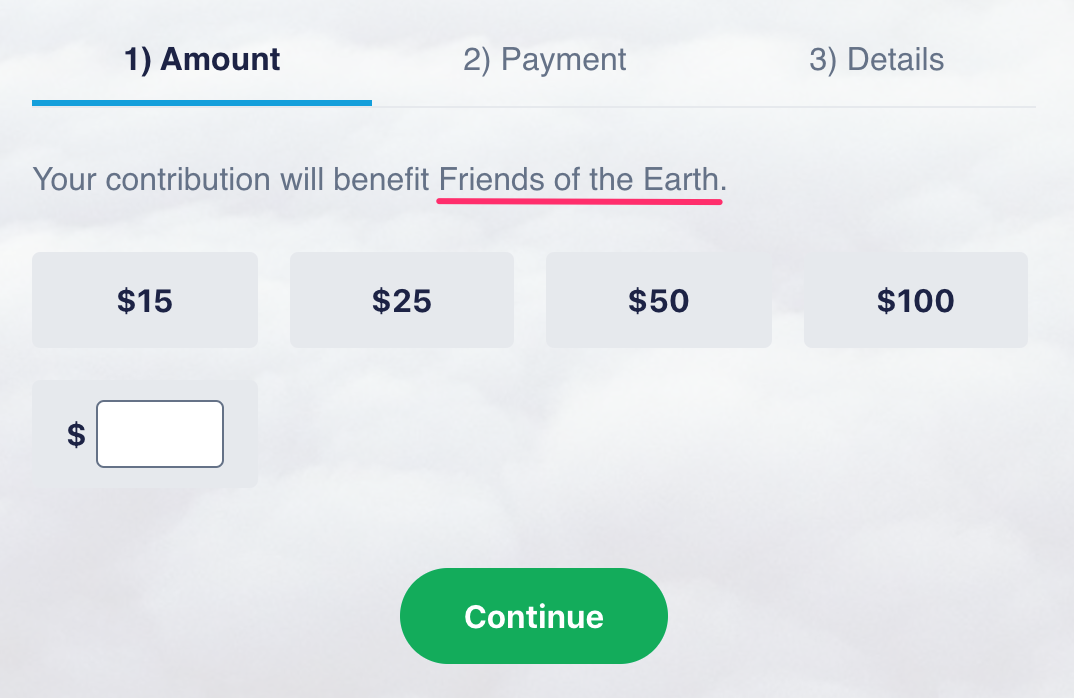

Standard Deduction 2019.

. Over age 65 or blind. Whether you actually end up getting a deduction depends mainly on whether or not you do what is called itemizing your deductions. Wrongfully claiming political contributions can and will attract the attention of the Internal Revenue Service and can lead to an assessment of additional taxes due penalties and interest.

According to the Internal Service Review IRS The IRS Publication 529 states. It doesnt matter if it is an individual business or other organization making the donation the campaign contribution is not deductible. Between his campaign and joint fundraising committees Trump raked in nearly 64 million from small-dollar donors during the first six months of 2019 an average of 350000 per day.

Start for 0 today Get your maximum refund with all the deductions and credits you. TaxSlayer Editorial Team July 23 2019. The same goes for campaign contributions.

2021-2022 Contribution Limits to Other State Committees Per Calendar Year. Otherwise the donations are not exempt from donors tax and not deductible as a political contribution on the part of the donor. Beginning January 1 2021 State campaign contribution limit will by default apply to city and county candidates when the city or county has not already enacted a contribution limit on such candidates.

Alternatively candidates could legally match donors political contributions using personal funds. People everywhere from radio blurbs to posts on social media are showing support for their respective candidates. An anonymous contribution of cash is limited to 50.

Are Campaign Contributions Tax Deductible. We all know that donations to charity are tax deductible. The May 2019 elections are fast approaching.

Some people express political Read more. This Standard Deduction is a flat deduction the IRS offers to everyone. AB 571 provides statewide campaign contribution limits applicable to City Council campaigns beginning in 2021 unless superseded by a local campaign limit ordinance or resolution.

The Natural State grants tax credits for statenot federalcampaign contributions of up to 50 for an individual 100 for a couple and it can be spread over multiple candidates political action committees approved by Arkansas and parties. The most tangible way to support a. The answer is no political contributions are not tax deductible.

50 limit on anonymous contributions. Fully one-fourth of these contributions come from donors living. For 2019 each individual is allowed to take 12200 off of income while couples can take 24400 off.

Like Arkansas Ohio only allows for contributions to candidates in statewide elections. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible. 1 A credit may not be claimed under ORS 316102 Credit for political contributions for tax years beginning on or after January 1 2026.

For many people the tax break from Uncle Sam is almost as big a motivating factor as altruism. Any amount in excess of 50 must be promptly disposed of and may be used for any. 18920 5 Comments Closed.

Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. The information in this article is up to date through tax year 2019 taxes filed in 2020. The answer is no donations to political candidates are not tax deductible on your personal or business tax return.

We Maximize Your Tax Deductions Credits To Ensure You Get Back Every Dollar You Deserve. 2 The amendments to ORS 316102 Credit for political contributions by section 49 of this 2019 Act apply to tax years beginning on or after January 1 2020 and before January 1 2026. Many believe this rumor to be true but contrary to popular belief the answer is no.

100 limit on cash contributions A campaign may not accept more than 100 in cash from a particular source with respect to any campaign for nomination for election or election to federal office. The answer is no donations to political candidates are not tax deductible on your personal or business tax return. You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund.

Therefore absent a local resolution or ordinance the provisions of AB 571 that amend the Political. Two-thirds of the maxed-out campaign contributions that members of Congress spend much of their time pursuing come from Americans living in the wealthiest 10 of zip codes in the United States according to a Public Citizen study The Well of the Congress released today. This stems from the presumption that campaign contributions are meant to be utilized by the candidate for his or her campaign and not for personal use and are thus not a proper inclusion to the candidates taxable income.

Its only natural to wonder if donations to a political campaign are tax deductible too. You cannot deduct expenses in support of any candidate. The City does not have campaign contribution or funding limits at this time.

Unutilizedexcess campaign funds that is campaign contributions net of the candidates campaign expenditures will be considered subject to income tax and as such must be included in the candidates taxable income as stated in his or her income tax return filed for the subject taxable year.

Charitable Contribution Letter Template Awesome Charitable Contribution Receipt Letter Template Donation Lettering Donation Letter Template Letter Templates

Taxability Of Campaign Contributions

Sponsorship Form Google Search Donation Form Receipt Pertaining To Professional Free Pledge Card Template Donation Form Card Template Card Templates Free

Explore Our Sample Of Charitable Contribution Receipt Templat Charitable Contributions Charitable Receipt Template

Foreign Based Political Contributions And Pacs Across Time This Figure Download Scientific Diagram

Taxability Of Campaign Contributions Atty Rodel C Unciano

Taxability Of Campaign Contributions

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Taxability Of Campaign Contributions

How The 3 Campaign Contribution Check Box On Your Tax Form Works Marketplace

Susie Lee On Twitter Campaign Finance Susie

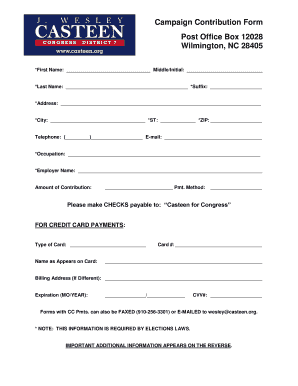

Fillable Online Casteen Campaign Contribution Bform Post Office Boxb 12028 Wilmington Nc Bb Casteen Fax Email Print Pdffiller

How The 3 Campaign Contribution Check Box On Your Tax Form Works Marketplace

Free Political Campaign Donation Receipt Word Pdf Eforms

Fundraising Planning Guide Calendar Worksheet Template Marketing Plan Template Nonprofit Fundraising Fundraising Marketing

Best Donation Cards Template Card Templates Free Card Template Card Templates Printable